Other than the Dow, the other two indices ended the week negative. Despite being light on data, the week was filled with volatility, with the “Sell in May” effect kicking in.

Other than the Dow, the other two indices ended the week negative. Despite being light on data, the week was filled with volatility, with the “Sell in May” effect kicking in.

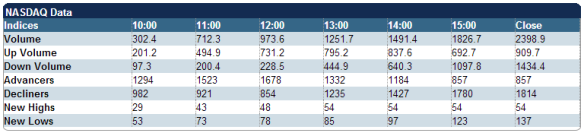

Market opened lower but rebounded significantly. Dow tested its high and was able to break above its open to close positive for the year.

Market opened lower but rebounded significantly. Dow tested its high and was able to break above its open to close positive for the year.

Data will continue to be light as we head into the last trading day of the week. The bulls have not shown a strong case all week and the bears will likely take control again in the coming session.

Direction for Friday 9 May 2014: Down

In particular, the biotech industry was volatile as the iShares Nasdaq Biotechnology ETF (IBB 226.44, +3.09) bounced between its 20- (226.18) and 200-day moving averages (223.16), but ultimately settled closer to its 20-day average with a gain of 1.4%.

Elsewhere, gains in high-beta technology and discretionary components like Facebook (FB 57.24, +0.48), Netflix (NFLX 328.55, +6.89), LinkedIn (LNKD 148.69, +3.62), and Priceline.com (PCLN 1135.91, +27.91) gave a boost to the overall risk sentiment. However, there were still some soft spots among the recent high flyers as Rocket Fuel (FUEL 21.83, -5.98) rocketed lower by 21.5% after its cautious guidance and revenue miss overshadowed its earnings beat.

Unlike momentum names, heavily-weighted tech components were relatively weak. That underperformance was evidenced by the largest member of the tech sector—Apple (AAPL 585.54, -2.45)—which fell 0.4% amid reports the company will acquire Beats Electronics for about $3 billion. In addition, the stock was downgraded to ‘Buy’ from ‘Strong Buy’ at ISI Group.

On the downside, this year’s leading sector—utilities (-1.4%)—spent the session in a steady retreat that trimmed its year-to-date gain to 10.9%. Meanwhile, the second-best sector of the year—energy (-0.2%)—was the second-weakest performer today, narrowing its 2014 advance to 5.2%.

Treasuries surrendered their overnight gains ahead of the open and spent the remainder of the session anchored to their flat lines. The 10-yr yield ended at 2.62%.

Today’s participation was below average as less than 640 million shares changed hands at the NYSE.

Economic data was limited to the Wholesale Inventories report for March and the March Jobs Openings and Labor Turnover Survey:

- Wholesale inventories increased 1.1% in March after increasing an upwardly revised 0.7% (from 0.5%) in February, while the Briefing.com consensus expected an increase of 1.0%. The BEA assumed that wholesale inventories increased 1.1% in March in the advance estimate of first quarter GDP. The upward revision to February, however, was not built into its model and will result in a positive contribution toward growth in the second estimate.

- The Job Openings and Labor Turnover Survey for March indicated job openings decreased to 4.014 million from 4.173 million.

On Monday, the Treasury Budget for April will be released at 14:00 ET. Also of note, Ukraine’s regions of Donetsk and Lugansk remain scheduled for independence referendums on Sunday.

- S&P 500 +1.6% YTD

- Dow Jones Industrial Average +0.04% YTD

- Nasdaq Composite -2.6% YTD

- Russell 2000 -4.6% YTD

Industry Watch

Strong: Consumer Discretionary, Consumer Staples, Health Care

Weak: Energy, Financials, Materials, Utilities

Market Movers

– Biotechnology and high-growth names display volatility

– Russell 2000 stages intraday turnaround after re-testing its low for the year

– Euro continues retreat after ECB President Draghi indicated yesterday the central bank is ready to act in June: euro/dollar pair slides below 1.38

WEEK IN REVIEW

The stock market kicked off the trading week on a sleepy note as the major averages spent the bulk of the Monday session near their flat lines. However, a final push during the last hour of action placed the key indices at new highs into the close. The S&P 500 added 0.2%, while the Russell 2000 (-0.1%) lagged throughout the day. Equities began the session on their lows as renewed global growth concerns, combined with continued worries about Ukraine, conspired to ensure a cautious start. In China, the HSBC Manufacturing PMI fell to 48.1 from 48.3 (expected 48.4), signifying a slowdown in manufacturing activities. Elsewhere, the European Commission warned about slower-than-expected growth by lowering its 2014 inflation forecast to 0.8%. The commission also trimmed next year’s inflation forecast to 1.2%, while lowering its 2015 GDP forecast to 1.7% from 1.8%.

Equity indices finished the Tuesday session on their lows after spending the entire day in negative territory. The S&P 500 tumbled 0.9% with nine sectors registering losses, while the Russell 2000 fell 1.6%, settling below its 200-day moving average for the first time since November 2012. Stocks were pressured from the get-go as index futures slid to their pre-market lows ahead of the opening bell. While the early slide was not brought on by a particular news item, it served as a reflection of the defensive sentiment in the foreign exchange market where the yen rallied to its best level in three weeks. The dollar/yen pair notched a session low in the 101.50 area, before inching up to 101.65 into the close. Once the session got going, dip-buyers tried to force a turnaround, but were unable to do so as some of the top-weighted sectors kept the pressure on the broader market. Most notably, the financial sector (-1.4%) underperformed for the second consecutive day. Influential components like Bank of America, Citigroup, and JPMorgan Chase lost between 1.6% and 2.3%, while AIG plunged 4.1% after reporting a bottom-line beat on revenue that missed estimates.

Stock indices finished the Wednesday session on a mixed note as high-growth names weighed on the Russell 2000 (+0.1%) and the Nasdaq (-0.3%), while the Dow Jones Industrial Average (+0.7%) and S&P 500 (+0.6%) outperformed thanks to strength in blue chip listings. The stock market opened the trading day with modest gains amid headlines indicating Russia’s President Vladimir Putin has reached out to OSCE chief and Swiss President Didier Burkhalter, attempting to de-escalate the Ukraine crisis through diplomatic avenues. Initially, the reports boosted overall risk appetite, sending Treasuries and the yen to lows, but those moves were retraced not long after. The yen returned into the middle of its trading range, while Treasuries reclaimed their losses and spent the afternoon near their flat lines. The benchmark 10-yr yield ended unchanged at 2.59%. Stock indices, meanwhile, surrendered their opening gains during the first hour of action, but only the Nasdaq Composite spent the remainder of the session in the red, while the Dow and S&P 500 rebounded swiftly.

The stock market ended the Thursday session on a defensive note despite showing early strength. The S&P 500 lost 0.1%, while the tech-heavy Nasdaq (-0.4%) fell nearly 60 points from its session high. Also of note, the Russell 2000 (-1.0%) settled below its 200-day moving average after failing to retake that level during the session. Today’s affair proved to be a bit of a rollercoaster ride as equities grinded higher in the morning, but rolled to fresh lows during the afternoon before climbing off those lows into the close. Fittingly, the areas that fueled the early advance (biotechnology and high-growth names) were the same spots that paced the afternoon slide.

| Index | Started Week | Ended Week | Change | % Change | YTD % |

| DJIA | 16512.89 | 16583.34 | 70.45 | 0.4 | 0.0 |

| Nasdaq | 4123.90 | 4071.87 | -52.03 | -1.3 | -2.5 |

| S&P 500 | 1881.14 | 1878.48 | -2.66 | -0.1 | 1.6 |

| Russell 2000 | 1128.80 | 1107.22 | -21.58 | -1.9 | -4.8 |

U.S. ECONOMIC DATA AND NEWS UPDATE

U.S. wholesale inventories jump 1.1% in March

WASHINGTON (MarketWatch) — U.S. wholesale inventories rose 1.1% in March, the Commerce Department reported Friday. The gain by itself will not have much impact on estimates first quarter gross domestic product as it was close the Commerce Department’s assumption in the report released last week. Wholesale sales advanced 1.4% in March. At March’s sales pace, the inventory-to-sales ratio was unchanged to 1.19 months. Inventories of durable goods rose 0.7% in March, and inventories of nondurables increased by 1.7%. Inventories rose by a revised 0.7% in February, up a bit from the prior 0.5% reading.

Job openings slip to 4.01 million in March

WASHINGTON (MarketWatch) — The number of job openings dropped in March to 4.01 million from 4.13 million, the Labor Department said Friday . The quits rate, a measure of worker confidence, was unchanged at 1.8% from an upwardly revised February level. The ratio of unemployed to job openings, at 2.61, rose from February’s 2.54.

EUROPEAN MARKETS

- UK’s FTSE: -0.4%

- Germany’s DAX: -0.3%

- France’s CAC: -0.7%

- Spain’s IBEX: -1.0%

- Portugal’s PSI: -1.8%

- Italy’s MIB Index: -1.6%

- Irish Ovrl Index: -0.9%

- Greece ATHEX Composite: -2.7%

Major European indices trade lower across the board. The euro has continued its retreat versus the U.S. dollar following yesterday’s comments from European Central Bank President Mario Draghi, who said the ECB is ready to act next month if needed. The single currency has dipped into the 1.3785 area against the dollar.

- Participants received several data points:

- Germany’s trade surplus narrowed to EUR14.80 billion from EUR15.80 billion (expected EUR16.60 billion).

- French government budget deficit widened to EUR28.00 billion from EUR25.70 billion (expected deficit of EUR33.00 biilion).

- Great Britain’s trade deficit narrowed to GBP8.48 billion from GBP8.75 billion (expected deficit of GBP9.00 billion). Separately, Manufacturing Production rose 0.5% month-over-month (expected 0.3%, prior 1.0%) and Industrial Production slipped 0.1% month-over-month (consensus -0.2%, previous 0.8%)

- Italy’s Industrial Production fell 0.5% month-over-month (expected 0.3%, previous -0.4%).

- Germany’s DAX is lower by 0.1% amid weakness in exporter shares. Adidas and Daimler are both down near 0.6%. On the upside, K+S leads with a gain of 1.8%.

- Great Britain’s FTSE holds a loss of 0.3%. Petrofac is the weakest index component, down 15.6% after issuing a profit warning. Discretionary shares outperform with Intertek Group and Marks & Spencer Group both up 1.9%.

- In France, the CAC trades down 0.5%. Steelmakers ArcelorMittal and Vallourec hold respective losses of 2.9% and 4.6% after ArcelorMittal reported mixed quarterly results.

- Italy’s MIB is lower by 1.2% as financials lag. Banco Popolare and Mediobanca are both lower by 5.0%.

ASIAN MARKETS

Asian markets entered the weekend on a mixed note. The Reserve Bank of Australia released its monetary policy statement, which raised the GDP forecast for the first half of 2014 to 3.00% from 2.75% and affirmed the full-year target at 2.75%; however, the 2015 GDP projection was lowered to 2.75%-3.75% from 3.00%-4.00%.

- In economic data:

- China’s CPI rose 1.8% year-over-year (expected 2.0%, previous 2.4%), while the month-over-month reading fell 0.3% (expected -0.1%, prior -0.5%). Separately, PPI decreased 2.0% year-over-year (consensus -1.8%, previous -2.3%).

- Japan’s Leading Index fell to 106.5 from 108.9 (expected 106.9).

- The Bank of Korea left its key interest rate unchanged at 2.50%, as expected.

- Japan’s Nikkei added 0.3%, climbing off its early low with help from industrials. Ebara and Mitsubishi Heavy Industries both surged near 7.0%. On the downside, Olympus and Yokohama Rubber fell 1.8% and 3.0%, respectively.

- Hong Kong’s Hang Seng tacked on 0.1%, ending little changed. Casino names rallied with Galaxy Entertainment and Sands China both up near 5.7%. China Unicom Hong Kong fell 2.7% after showing considerable strength over the past week.

- China’s Shanghai Composite shed 0.2% after being unable to make a sustained move into the green. Great Wall Motor tumbled 10.0% and BTG Hotels Group lost 8.5%.

- India’s Sensex (+2.9%) soared with some attributing the move to an interview with Narendra Modi, who appeared confident the BJP would win a clear majority in the country’s election. HDFC Bank and ICICI Bank surged 5.4% and 7.0%, respectively.

- Australia’s ASX (-0.3%) posted a slim loss. ANZ Banking Group weighed, falling 3.2% as the stock went ex-dividend.

- Regional Decliners: Taiwan (-0.5%), Thailand (-0.1%)

- Regional Advancers: Indonesia (+0.8%), Malaysia (+0.2%), Philippines (+1.2%), Singapore (+0.1%), South Korea (+0.3%), Vietnam (+2.9%)

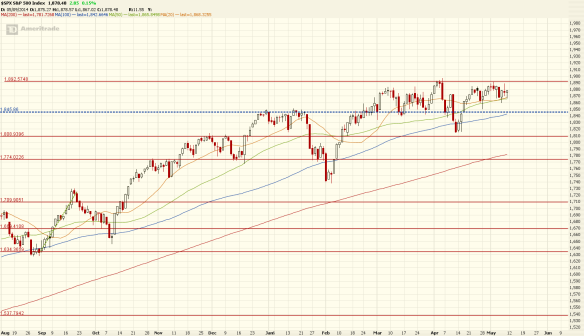

TECHNICAL UPDATE

Dow settled positive for the year and made its highest close for the year. It has now formed a Hanging Man which could signal more downside in the next session.

Dow settled positive for the year and made its highest close for the year. It has now formed a Hanging Man which could signal more downside in the next session.

Nasdaq formed a Bullish Engulfing pattern, signalling a possible reversal towards the upside in the coming session.

Nasdaq formed a Bullish Engulfing pattern, signalling a possible reversal towards the upside in the coming session.

Unlike the Dow, S&P 500 did not test its high, but had also formed a Hanging Man pattern, signalling possible downside.

Unlike the Dow, S&P 500 did not test its high, but had also formed a Hanging Man pattern, signalling possible downside.

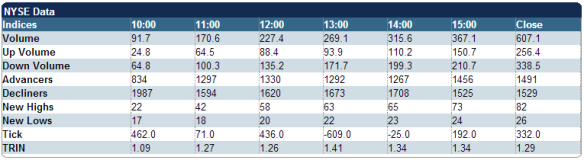

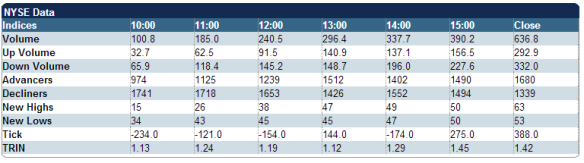

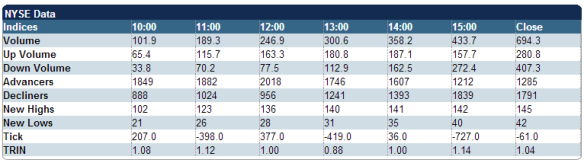

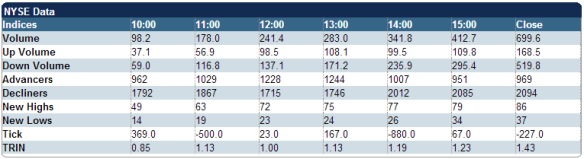

MARKET INTERNALS

NYSE:

Lower than previous day volume @ 636.8 mln vs 694.3 mln

Advancers outpaced Decliners (Adv/Dev): 1680/1339

New Highs outpaced New Lows (High/Low): 63/53

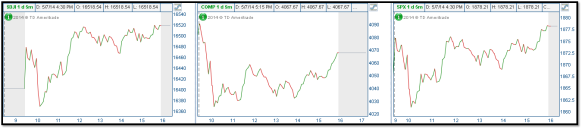

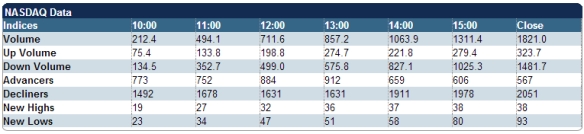

NASDAQ:

Lower than previous day volume @ 1956.5 mln vs 2398.9 mln

Advancers outpaced Decliners (Adv/Dev): 1677/952

New Lows outpaced New Highs (High/Low): 20/133

- NYSE: DVOL outpaced UVOL at a pace of 1.14:1

- Nasdaq: UVOL outpaced DVOL at a pace of 1.51:1

Volumes dipped further. Despite the strong reversal into the close, internals showed the general market were more bearish with the TRIN ticking higher into the close. This could signal that the late recovery was the covering of the shorts for the week.

COMMODITIES UPDATE

Precious metals started floor trade in positive territory but gave up early gains as the dollar index rose higher. June gold pulled back from its session high of $1293.90 per ounce set in early morning action and fell into the red. It touched a session low of $1285.50 per ounce and settled 40 cents below the unchanged line at $1287.60 per ounce, booking a loss of 1.2% for the week.

July silver retreated into negative territory after trading as high as $19.24 per ounce. It settled 0.2% lower at $19.11 per ounce, bringing losses for the week to 2.3%.

June crude oil also erased morning gains as it pulled back from its session high of $101.21 per barrel and slipped into negative territory in early afternoon action. The energy component brushed a session low of $99.71 per barrel moments before selling with a 0.2% loss at $100.02 per barrel. Today’s decline shaved gains for the week to 0.2%.

June natural gas fell deeper into the red after retreating from its session high of $4.57 per MMBtu set moments after floor trade opened. It traded as low as $4.50 per MMBtu and eventually settled 0.9% lower at $4.53 per MMBtu, booking a 3.0% loss for the week.

CURRENCIES UPDATE

- The Dollar Index presses session highs near 79.90 as trade looks likely to close at its best level in two weeks.

- Traders continue to watch resistance in the 80.00 area, which has posed problems over much of the past month.

- EURUSD is -85 pips @ 1.3755 as trader presses to one-month lows. The single currency has seen a sharp reversal off yesterday’s highs as comments by ECB head Mario Draghi pointed to potential action at the June meeting. Action has tumbled almost 250 pips from yesterday’s peak, and is now moving towards a test of support in the 1.3700 area that is helped by the 100 dma.

- GBPUSD is -80 pips @ 1.6850 as sellers remain in charge for a third day. Today’s weakness comes despite manufacturing production, the trade balance, and NIESR GDP Estimate all exceeding forecasts. The 1.6800 area should provide some minor help, but 1.6700 is the more important level.

- USDCHF is +65 pips @ .8865 as trade rallies to a one-month high. The recent win streak has the bulls targeting resistance in the .8950 area, but a test of the level will likely only come on euro weakness as the two currencies remain highly correlated. Swiss data is limited to retail sales.

- USDJPY is +10 pips @ 101.75 amid a lackluster session. Trade has been limited to a tight 30 pip range, causing many participants to look elsewhere for opportunity. The 100.00/100.25 level remains key in the days ahead. Japan’s current account balance will cross the wires Sunday evening.

- AUDUSD is -10 pips @ .9355 as action slips back towards session lows. The hard currency has spent virtually the entire session in negative territory as the dovish RBA minutes and cool Chinese CPI and PPI data weigh. Australia’s NAB Business Confidence is due out Sunday night.

- USDCAD is +70 pips @ 1.0900 as trade has recouped all of yesterday’s losses on the back of the disappointing Canadian jobs report (-28.9K actual v. 12.8K expected) that saw the unemployment rate hold steady at 6.9%.

BOND MARKET UPDATE

Selling Weighs on Long Bond

- Treasuries saw a mixed week as buyers were in control up front while selling took place in longer dated maturities.

- This week’s economic data saw ISM Services (55.2 actual v. 54.0 expected) and the trade balance (-$40.4 bln actual v. -$40.6 bln expected) exceed forecasts while productivity-prel. (-1.7% actual v. -1.2% expected) fell short of estimates.

- Fed Chair Janet Yellen’s testimony in front of the Joint Economic Committee was littered with much of her usual commentary as she suggested the U.S. economy remained on track for “solid growth.” Ms. Yellen did however express some concern regarding the recent slowdown in housing as she noted, “The recent flattening out in housing activity could prove more protracted than currently expected, rather than resuming its earlier pace of recovery.”

- A solid bid up front dropped the 5y -4bps to 0.379% as action settled near a three-week low. Support in the 0.350% area will be watched closely in the days ahead.

- The 5y shed -4bps to finish the week @ 1.625%, on its 100 dma. The 1.550% support area is setting up as a key level as the 200 dma also lurks in the vicinity.

- The 10y added +4bps to 2.623%. Action over the past week has pressured key support in the 2.600% area, but so far it has held up.

- At the long end, the 30y lagged significantly, rallying +11bps to 3.467%. Nearly the entire run up in yield came Thursday afternoon and Friday as traders digested the weak 30y auction. Friday’s close was the highest since May 1.

- This week’s auctions were mixed.

- Tuesday’s $29 bln 3y note auction. The auction was solid, drawing 0.928% and a 3.40x bid/cover. A light indirect takedown (28.1%) was offset by a strong showing from direct bidders (24.5%). Primary dealers ended up with 47.4% of the supply.

- Wednesday’s $24 bln 10y note auction was strong. The auction drew 2.612% and a 2.63x bid/cover. Solid takedowns from both indirect (49.2%) and direct (21.6%) bidders left primary dealers with only 29.2% of the supply.

- Thursday’s $16 bln 30y bond auction was weak. The auction drew 3.400% (WI 3.403%) and a tepid 2.09x bid/cover, the lowest since August 2011. Indirect (40.3%) and direct (8.4%) bids both fell short of their twelve auction averages, leaving primary dealers with 51.3% of the supply.

- This week’s action swung the curve steeper as the 5-30-yr spread blew out to 184bps.

2yr: 0.40 unch

5yr: 1.63 unch

10yr: 2.62 +0.01

30yr: 3.47 +0.02

Longer term maturities continue to sell off from the previous day. The yield curve continued to steepen along the longer end.

SUMMARY

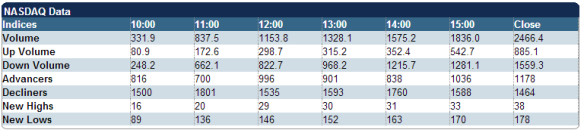

A volatile week despite being light on data. The late rally was most likely brought on by short-covering for the week. Dow managed its highest close for the year but don’t let the indices fool you, the week had seen more bearishness than it had for some time, judging from the internals. However, we had not seen the full force from the “Sell in May” effect , but i do believe we will sell off much more this May.

Dow tested the year’s open but was unable to stay above it. It has now formed a Shooting Star candlestick formation, which could signal a reversal from the resistance.

Dow tested the year’s open but was unable to stay above it. It has now formed a Shooting Star candlestick formation, which could signal a reversal from the resistance. Nasdaq has now formed a Bearish Crucifix Doji, signalling potential downside. Support will be strong at 4,000, before hitting its 200-day MA.

Nasdaq has now formed a Bearish Crucifix Doji, signalling potential downside. Support will be strong at 4,000, before hitting its 200-day MA.

Dow stay mired within its year opening and the next support at 16,250. It is currently in no man’s land, resting on the 50-day MA. It has now formed a Bullish Harami candlestick formation, which could signal a break in the current sideway trend to the upside. Resistance will once again be strong at the year’s open at 16,572.

Dow stay mired within its year opening and the next support at 16,250. It is currently in no man’s land, resting on the 50-day MA. It has now formed a Bullish Harami candlestick formation, which could signal a break in the current sideway trend to the upside. Resistance will once again be strong at the year’s open at 16,572. Nasdaq could bounce after a Hammer and a possible third candle reversal in the next session. Resistance is at the year’s open at 4,160.

Nasdaq could bounce after a Hammer and a possible third candle reversal in the next session. Resistance is at the year’s open at 4,160.

Next level of support is the big round number of 4,000.

Next level of support is the big round number of 4,000.

Despite the recovery, the Dow was unable to break above its high and closed near the resistance with a Hanging Man. Seems like more downside potential as we continue into May.

Despite the recovery, the Dow was unable to break above its high and closed near the resistance with a Hanging Man. Seems like more downside potential as we continue into May. The tech-heavy index made solid gains despite opening lower, mainly due to AAPL pushing through $600 since 2012. Similar to Dow, it was unable to break above the year’s open.

The tech-heavy index made solid gains despite opening lower, mainly due to AAPL pushing through $600 since 2012. Similar to Dow, it was unable to break above the year’s open.